Gheewala Associates is a company known for providing the best Tally Sales & Support and Tally Customization Services. We are a company based in Mehsana, Gujarat. Gheewala Associates is also the support Centre for Tally users. We choose to provide Tally sales Support to the Tally ERP 9, Tally Prime, & Tally TSS Users. We are the best Tally Accounting Software Provider in Mehsana.

We are best known for providing After-sales Support. Our Software's are easy to learn and our services are easy to adapt. We are known to be the best Tally ERP 9 Authorized Dealers in Mehsana, Gujarat. We are also known to be the best Tally Support Centre all across India. We are best known for providing the Tally Training that best suits the Tally Software Users.

Also, if you are looking for Tally ERP Accounting Software Dealer in Mehsana, Gheewala Associates is known to be one of the best Tally ERP Accounting Software Dealers in Gujarat. Best Tally ERP Dealer in Mehsana, Gujarat!! Gheewala Associates is the one. We are acclaimed as the best Tally ERP 9 Dealer in Mehsana and known by the name of the best Tally ERP 9 Dealer in the Gujarat region.

Years

Customer Base

Students

Job Placements

JIT inventory management is being used by most businesses as an inventory tool to manage optimum inventory levels.

What is just-in-time or JIT inventory management? JIT is also referred to as lean management. JIT means an inventory management system whereby raw materials are ordered just before production but not before that. The objective of JIT is to have minimal inventory in hand so production can begin and then get the raw materials and inventory as the need arises. JIT depends heavily on supplier efficiency and so isn’t an inventory management option for all types of businesses. However, its advantages far outweigh its disadvantages which makes it an inventory management technique to consider.

Quick Tips for Buying the Best Inventory Management Software | 7 Must-Have Features & Functions for Inventory Management Software |

JIT requires you to have the stock before production begins so that it is available to the customer after he places an order. The key is to have the stock just as you require but not way in advance. You must have long-term contracts with your suppliers to ensure JIT works for your business. Of course, you want to factor in the reliability of the suppliers because only those who always fulfill demands and ensure timely delivery must be considered to ensure you get the stock on time with zero delays. JIT requires stellar collaboration because every person involved has to do his job correctly for inventory management to work.

This is important because people need to regularly inform each other and talk to each other to ensure production flow and supply flow are taking place as they should. This dependence will bring the benefits that are associated with JIT and ensure that the process is working smoothly without any bottlenecks. JIT requires constant monitoring and improvement for its continuous success. The aim is always to have sufficient stock to avoid wastage and to ensure product quality while reducing unnecessary costs and expenses along the way. JIT can be implemented in a variety of ways but there are some general steps that every business must take.

JIT starts with the design process whereby the required manufacturing components are determined and identified. The next step is to manage and this is where the roles are defined. The pull step is when the team is explained about the production methods. The next step specifies the supplier list and negotiations also take place. The next step requires refining of controls and identification of inventory requirements. Then the teams are informed about their roles and responsibilities in the JIT process. Once all of these steps are complete, the refining stage takes place whereby the production is made more efficient. The last step is to review and implement after thorough analysis.

JIT inventory management has several advantages as follows.

Leads to higher efficiency

JIT lowers raw material inventories as you are not storing more than required raw materials in your warehouse. It improves inventory turnover ratios which is beneficial for your business. It promotes local sourcing which lowers delivery times and eliminates the need to store extra stock.

Reduces waste

JIT ensures there is minimal waste because you order only what is required. This decreases and eliminates dead stock. It keeps unsold stock to the minimum because you have the inventory you require. It lowers scrap costs as damaged and defective products can be more easily identified.

Decreases expenses and costs

JIT lowers costs as you have lower inventory carrying costs. It lowers how much working capital is required and also lowers the cash expenditure due to lower levels of inventory. It reduces labor costs and due to freeing up of resources, you can direct them elsewhere.

Improves productivity

It cuts down the time required to manage extra inventory. This improves product turnaround. JIT improves the ability to make changes to existing products. It cuts down on production runs as manufacturers become capable of delivering products.

Enhances quality

Businesses can focus on quality which in turn ensures higher customer satisfaction. As the number of defective products will decrease due to them being less prone to damage, it will ensure a better quality of products. JIT helps to lower the number of work-in-progress products too.

Better production

JIT improves production flow because it will lower the number of delays that take place in the supply chain. It reduces the time it takes to manufacture products and shortens the production runs. It lowers scrap levels too.

JIT inventory management has its set of pitfalls as follows.

Heavy reliance on forecasting

A forecast cannot be trusted completely because demand can suddenly arise. This can weaken your business’s ability to meet those demands. In such cases, you can lose your customers and revenue because you won’t be able to satisfy your customers.

Disruption causes delays and inefficiencies

When you use JIT inventory management, you must be ready and prepared for disruption. But sometimes even the most prepared businesses can become paralyzed due to disruptions that directly impact the production process.

Costs and expenses can rise

JIT depends on the constant ordering of inventory to lower inventory costs. This means you will be affected when the prices of raw materials change and this means higher costs when the prices rise above normal. You won’t have much time to shop around which can increase expenses.

Supplier delays stalls production

Even if your supplier always sends inventory on time, it can falter and this can affect the entire production. When this happens you won’t be able to fulfill customer orders as production delays will take place.

Just in time inventory management is useful in a variety of scenarios and a wide range of businesses can use it. It is used in health care sectors to keep their costs and expenses low. Publishing uses JIT, especially authors who publish their books. This ensures they don’t have to deal with the wastage of unsold books. The construction industry uses JIT as storing inventory costs can add up quickly causing a sharp rise in expense. Using JIT enables the industry to minimize materials movement and keep expenses minimum. The automotive industry uses JIT and this was one of the first industries to use JIT. It helps maintain competition.

The apparel industry uses JIT as it must ensure it is aligned with the trends that change rapidly. This allows them to store only what is necessary and reduce unnecessary expenditure on clothes that may be out of fashion. The fast-food industry especially franchises use JIT because it allows them to use fresh ingredients rather than store ingredients for long periods. Retail uses JIT because it allows it to store sufficient inventory thereby cutting costs of storing more than necessary. Another industry where JIT is used is manufacturing where production costs are high and using JIT minimizes inventory to improve efficiency.

As stated earlier, JIT is excellent and many renowned brands have found success with this inventory management method. But JIT is not for every business. If you want to convert to JIT, then there are a few factors you should consider. You should only move forward if all of these requirements are met.

Are your suppliers reliable?

If you have worked with suppliers who have always delivered on time and delivered safely, then you can try JIT. You should be capable of fulfilling orders even when there are delays in the supply chain.

How willing are your employees to change?

JIT requires your employees to understand the process and it requires quite some work from your end as you have to properly train your employees. JIT works best when everyone is on board.

Do you have forecasting abilities?

JIT also depends on the forecasting capabilities of the business. Do you have the tools and the information you need to forecast demand? If yes, then JIT may be for your business.

Can your supplier fulfill demand quickly?

Strong supplier relationships form the basis of JIT's success. If you are working with your suppliers for a long time and they are capable of fulfilling your demand quickly then you can consider JIT.

Can you deal with disruptions?

What if natural disasters take place? Will your supplier be able to fulfill your demands at that time? You need to be capable of dealing with sudden problems that can arise before converting to JIT.

Do you have agile inventory management software?

You need trustworthy inventory management software to manage your inventory with JIT. The software should be capable of giving you insights on trends, stock movement, aging analysis, profitability, re-order status, etc.

TallyPrime is an accounting system with a robust inventory management system. It comes with a host of inventory reports and utilities to manage your business inventories efficiently. It easily adapts to your business needs to give you incredible performance every single day. With its insightful reports, you can make decisions that truly matter and make a difference to your business. TallyPrime has features such as warehouse management, bill of materials, batch-wise and stock-wise management, reorder level, job-work management, and much more. Try TallyPrime today.

Business operations of the service industry vary from business to business. To broadly classify, some businesses are purely into services like consultancies, who generally do not need to manage inventory. On the other side, some businesses are in the service industry, but deal with inventories as well. For example, businesses who are into automobile servicing, whose primary nature is service, but also sell spare parts as a part of overall delivery. No matter what nature of service business you are dealing with, ERP for service industry plays a crucial role in enhancing the efficiency and productivity of your business.

Depending upon the nature of business and the operation, the complexity of managing business varies. If you are purely into a service business, the primary need can be managed billing and receipts from the clients, but there are other areas such as costs, receivables etc. that need to be managed. If you deal with inventory while the primary nature of the business is of service, the needs and complexities get amplified. Here is why ERP for service industry plays an important role.

| What is ERP? | Types of ERP Software System |

Below are some of the key reasons why service industries need an ERP software solution.

Whether you are rendering pure services or into a service segment that requires you to manage inventory, invoicing/billing is a crucial aspect of the business. Using ERP software solution for service industry, you can easily record, track, and manage the invoices. The software solutions that are built for small and medium service business comes with different types of invoices format sand configurations that help you customise the way it works for your business.

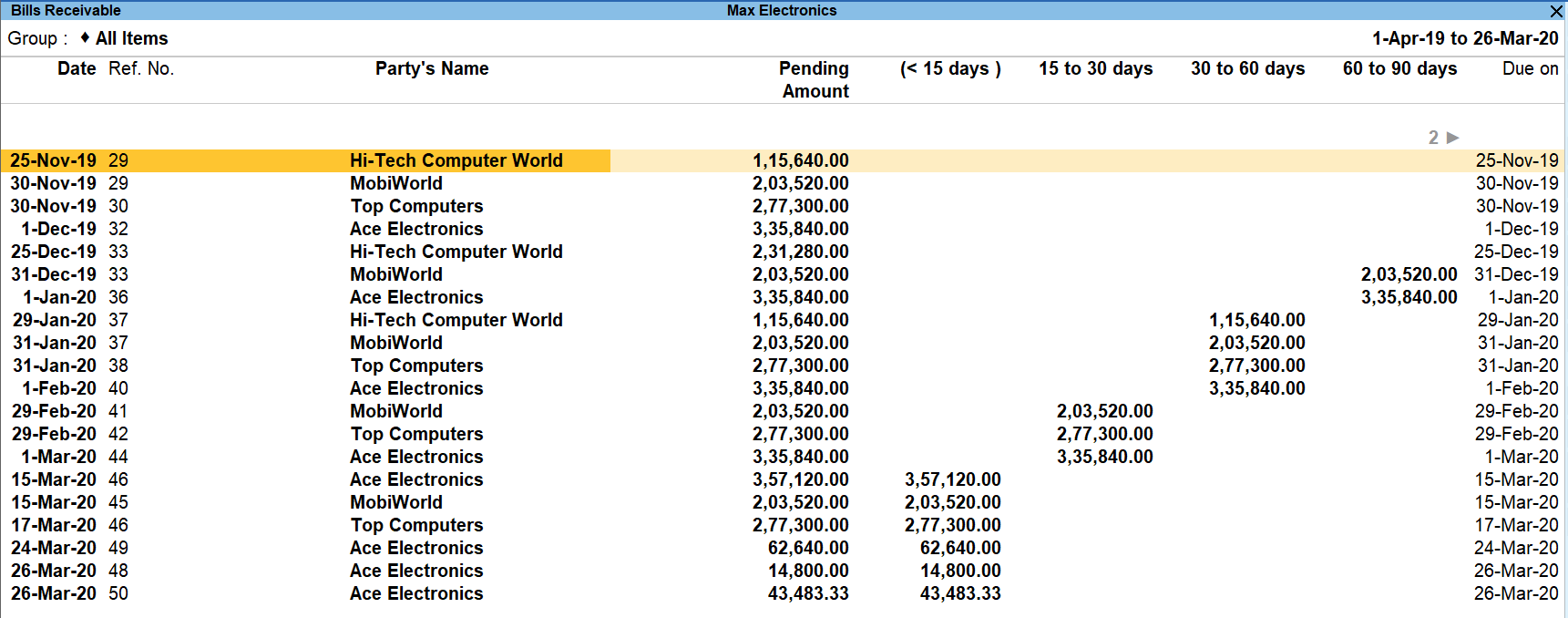

Bills receivables are the invoices that are yet to be paid by your customer. Bills receivables are the key source of cash inflow and contribute hugely towards the working capital requirement of the business. The longer an invoice sits as accounts receivable, it blocks the cash flow and lesser availability of cash to meet your business needs. Using ERP software for services business helps you keep a clean track of receivables, how long they are pending from and help you follow up with your client. Take a look at the best techniques to Manage bills receivable efficiently.

This is extremely crucial for businesses that not just render services, but deal with inventory as well. The complexity here is that some service business uses their own inventories like automobile service business providing repairs and maintenance service uses their spare parts as part of completing the service. On the other end, you have businesses rendering service and use the components/inventories provided by their client like in the case of job work.

To make it even more complex, you might come across situations, where you must manage your stock as well as the stock provided by your client alongside rendering the required service. ERP software solution is not only built with features to manage your books but also includes the features of inventory management software that help you handle such situations easily.

It’s quite a common scenario that service businesses manage the delivery by projects. Here, all the cost, material consumption and revenue attributed to the project to track the revenue. Using ERP software will help you create multiple projects, track cost, including material consumption till the time of issuing an invoice.

Depending upon the tax compliance, such as GST in India,VAT in UAE, Saudi Arabia and other countries, businesses need to be compliant right from generating the tax compliance invoice to managing the books of accounts to filing returns. ERP software solution for service business comes with an inbuilt solution to manage tax requirement of business easily.

TallyPrime is a complete business management software that helps you manage the complete needs of your service business. Using TallyPrime, you can manage invoicing, accounting, inventories, payroll, banking,cash flow and much more in an efficient way. Here are some of the key features of TallyPrime for service business

The robust features of TallyPrime understand your business needs, simplifying the lives of businesses through simple to use software, insightful reports, multi-task capability and much more. This is something that is loved by our 2 Million + customers across the world. Take a free demo and experience yourself.

Any business requires cash to operate. Cash will constantly move in or out of the business. There is inventory to be purchased, salary or bills to be paid, payments to be received. While all understand the importance of cash in business, it often becomes difficult to determine if the flow of cash in and out of the business is healthy enough to sustain and grow the business.

Without adequate planning and management, it will become difficult to allocate funds for various expenses, invest into the business or pay the bills. Cash flow mismanagement is one of the major reasons why businesses fail. A healthy Cash flow is an important metric measuring the health of the business.

Below are five of the most common mistakes businesses make when forecasting cash flow.

Many businesses do not plan a budget for future cash flow. Not all months/quarters will be similar in terms of sales and expenses. There may be a lean sales period during which additional cash reserves would be needed to manage operations. Before an anticipated period of high sales, sufficient inventory must be purchased leading to additional expense

| 6 Tips for Efficient Cash Flow Management | Tips to Manage Accounts Receivables Efficiently |

Planning this inflow and outflow of revenue and expenses with a budget will help businesses plan ahead to ensure that the cash flow is maintained throughout, and the business is not cash strapped.

Some (or all) customers may order first and pay later. While this may be a common practise in the industry, if one isn’t proactive in tracking and collecting pending payments, this could leave you severely cash strapped. Payments to employees and vendors may go on hold and you may be unable to purchase inventory for future sales.

Knowing when you will receive payments from customers in advance helps pre-emptively plan the other expenses and activities.

It is thus important to regularly track the pending receivables and set adequate customer policies for receivables and outstanding collection.

In a business, there are times when things do not go as planned. The sales projected for a given period may not happen. A negative event may lead to additional expenses. Different scenarios may play out; however, you may have considered only the best-case scenario while forecasting cash flow.

One must plan for various ‘what-if’ circumstances and create plans for best- and worst-case scenarios. Visualizing this while forecasting your cash flow will prepare you for the negative and positive impacts while managing your cash flow.

In order to generate sales, a business will have to spend money. These could be inventory expenses, marketing expenses or any other customer acquisition cost. However, spending too much money in anticipation of generating sales can lead to a cash crunch. Investing heavily in growth if it leads to a negative cash flow is counterproductive.

Hence, before committing to such investments, the business should consider which expenses are critical and necessary and how they can be phased out in order to not impact the cash flow all at once. It is also important to update projections every time something happens in business that could affect cash flow.

Having a poor process for payment and for tracking of receivables & payables will make cash flow management a complicated process. Business expenses may have a varied payment schedules (salary is to be paid monthly, insurance may be quarterly etc). Similarly, it should be easy for your customers and vendors to commercially transact with you (each may have different credit period set up).

Without an up-to-date accounting software and or payment systems in place, you risk being paid late, missing receivables and not being able to accurately assess your monthly cash flow. Having an automated system that helps you in forecasting gives you an upper hand in managing any cash flow shortages and plan for it in advance.

Mapping out the business strategy using the cash flow forecasting gives the business owner direction and confidence in this pursuit of growth. Cash flow forecasting is one of the most essential and effective tools an organisation can have to ensure business runs smoothly and there is sufficient fund available for continuous growth.

With a single interface, you can toggle to different modes of recording/altering a transaction without worrying about the pre-configuration or settings.

For example, in TallyPrime, you can record transactions in the following modes as per your business requirement:

With a single interface, you can toggle to different modes of recording/altering a transaction without worrying about the per-configuration or settings.

For example, in TallyPrime, you can record transactions in the following modes as per your business requirement:

Item Invoice

Accounting invoice

Single entry

Double entry

Forex gain or loss

Interest calculation

Use as Manufacturing Journal